lv mortgage insurance Mortgage Life Insurance, also known as decreasing life insurance, decreasing term assurance (DTA) or Mortgage Term Insurance, is used to cover any remaining balance on your capital and interest repayment mortgage if you .

Dagannoths are a great monster to get on task. Cannoning them will result in some really high experience rates for both slayer and range, and they commonly drop some useful seeds – including medium clue scrolls.

0 · lv lifetime mortgage rates

1 · lump sum lifetime mortgage

2 · liverpool victoria mortgage

3 · liverpool victoria lifetime mortgage

4 · liverpool victoria equity release mortgages

5 · liverpool victoria equity release adviser

6 · lifetime mortgage advice

7 · lifetime equity release mortgage

By Bob & Jenn Bassett Updated on November 26, 2023. The Golden Nugget Las Vegas pool is like no other in the city. The award-winning pool complex features a shark tank, so you really can swim with the fish – in a good way! At the center of the main pool is a 200,000-gallon shark tank, with a waterside that runs right through .

Here is all you need to know about making a mortgage and lifestyle protection claim with LV=. Whether by accident, sickness or unemployment, we're here to help.Over a million members and customers trust us to look after their futures, .

For all your car, home, travel, pet and other insurance enquiries Life, Investments, .Mortgage Life Insurance, also known as decreasing life insurance, decreasing .LV= is launching a simple and affordable income protection product designed to .Mortgage Life Insurance, also known as decreasing life insurance, decreasing term assurance (DTA) or Mortgage Term Insurance, is used to cover any remaining balance on your capital and interest repayment mortgage if you .

lv lifetime mortgage rates

LV= is launching a simple and affordable income protection product designed to help pay mortgage or rent payments, if illness or injury prevents the insured person from working. .

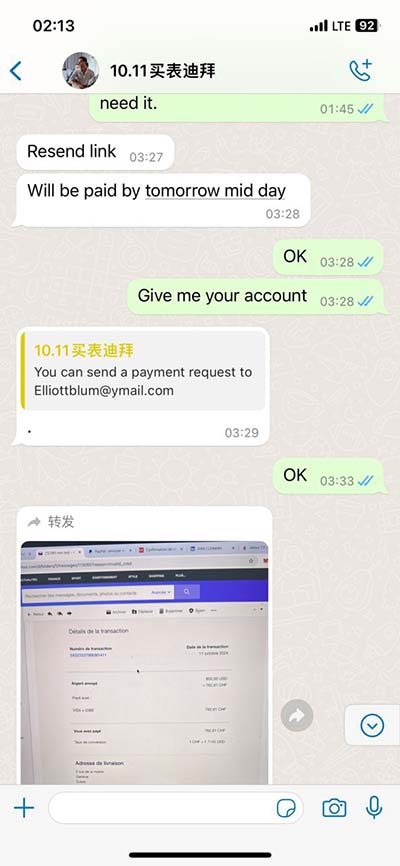

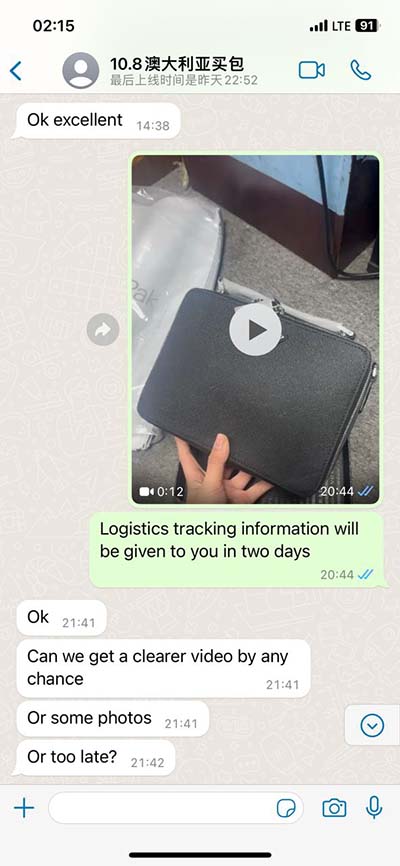

dolce gabbana the one original vs fake

Mortgage life insurance, or mortgage protection insurance, refers to a set of life insurance products that are designed to pay your outstanding .Ever wondered who LV= are, how we operate, what we do and why we have over 5 million members & customers in our friendly society? . For the 7th consecutive year, our Lifetime Mortgage Drawdown+ and Lifetime Mortgage Lump Sum+ .

We put protecting income at the heart of our menu plan, making it easy for you to recommend the LV= Flexible Protection Plan to your clients. Our menu plan includes a complete package of products with flexible options, allowing you to .LV= Income Protection provides comprehensive cover for families with tailored options for doctors, surgeons, dentists, teachers and renters. It also includes a number of special features at no extra cost, including parent and child cover, .Mortgage term assurance is another name for life insurance which is used to to repay a mortgage. This is usually decreasing term where the value of the mortgage goes down over time (capital and interest), or level term to pay an interest only mortgage.

With a lifetime mortgage, the tax-free cash can be taken as either a lump-sum or you can 'draw down' the money as income depending on the option you choose. You still own 100% of your home with a lifetime mortgage. If you pay off your current mortgage with the lump sum, you can choose to spend the leftover cash in a variety of ways.LV= life insurance policies are all for a specific term, and can be set up as either: Level cover life insurance. Decreasing cover life insurance. . What happens to life insurance when the mortgage is paid? If you have taken out life insurance to cover the mortgage, you can choose for it to end when the mortgage is due to have been paid off. .Lifetime Mortgage Lump Sum; Lifetime Mortgage Drawdown; Equity Release calculator; Types of Equity Release; Guides; . LV= Flexible Guarantee Bond; LV= Smoothed Managed Funds Bond; LV= Flexible Transitions Account; . pet and other insurance enquiries. Life, Investments, Pensions and Retirement. For all life insurance, investments retirement .If you have previously cancelled an LV= Life Insurance and/or LV= Life Insurance & Critical Illness plan you will not qualify for this offer. If you are eligible to receive an e-Gift card, we will aim to send the e-Gift card via email within 28 days of us receiving your 6th monthly premium. Please allow time for delivery.

Lifetime mortgage interest rates. As with a residential mortgage, there will be an interest rate applied to your lifetime mortgage. This interest rate is normally fixed and will not change for the duration of the lifetime mortgage, though some products can have a variable rate. The rate applied will depend on the lender and product selected.30% (4.3m) of mortgage holders and 43% (3.4m) of private renters are worried about money; But only 12% of mortgage holders and 5% of private renters have income protection insurance to provide an income if illness of injury stops them working; LV= is launching Mortgage and Rent Cover for those with fluctuating incomes, as well as regular earnersJoint life insurance. A joint life insurance policy covers two people. It pays out when one person on the policy passes away. The policy ends after this. It’s commonly used by couples with children to ensure the remaining family is protected or to pay off a jointly held mortgage.

Mortgage protection insurance pays off your mortgage if you die. But for most people, term life insurance is a better deal. Credit cards . Credit cards ; View all credit cards ;LV=’s Life Protection protects loved ones against financial hardship if your client dies. Learn more about cover features and benefits here. . Whether it’s to help pay off a mortgage, support children if they go to university or simply to ensure your client’s family have money to live on – Life Protection offers this peace of mind .

The ability to transfer your lifetime mortgage is not guaranteed and will depend on your new home being accepted by us. If, following the valuation, your new home does not meet our lending criteria and you still decide to move, you must repay your lifetime mortgage as part of the sale of your property. You may have to pay an early repayment charge.Are you an existing LV= Life Insurance customer? Call LifeSearch 0800 197 2266. The advice process. Finding your perfect insurance match is as easy as 1, 2, 3. 1. . The mortgage amount has left them worried about how they would .What happens to mortgage life insurance after divorce? Couples often take out life insurance when they get a joint mortgage. That way, if one of you dies, the other receives a payout to clear the outstanding debt. However, this type of life insurance may not be suitable after a divorce, especially if that means a change in living arrangements. Lifetime Mortgage Lump Sum Plus; Lifetime Mortgage Drawdown Plus; Lifetime Mortgage Lump Sum Lifestyle; Lifetime Mortgage Drawdown Lifestyle; More. Equity Release Portal; . Financial questionnaire for LV= Life Insurance Personal Cover. Add to bulk email/download list . Flexible Transitions Account key features. Ref: 0043922-2024 Last .

If you’ve got a capital and interest repayment mortgage and specifically choose a decreasing-level life insurance policy, your life insurance coverage will decrease over the policy term, in a similar way to the total amount you owe on your mortgage reduces as you continue to pay off your mortgage. It is ideal if you want to cover any big .Advantages: Disadvantages: Leave a legacy: Senior life insurance provides a guaranteed payout so you can leave your loved ones or chosen beneficiaries a gift when you die. Pay off your mortgage: If you have a mortgage, you could take out mortgage life insurance which will pay off the outstanding debt should you pass away. Lower inheritance tax: Senior life insurance .

Critical Illness Mortgage* Critical Life Lifetime* Critical Life and Mortgage* Critical Mortgage* Decreasing Term Assurance (mortgage linked, family income benefit)* . *These products were first issued by Permanent Insurance Company Limited and then by LV= under the same name product name. LV= Business Protection products.lv Insurance Protect what matters most with insurance that comes from the heart. Car insurance. Defaqto 5 Star rated car insurance for all the cars in your household. *Customers buying online receive a 5% discount. Excludes optional add ons. Get a car insurance quote.Life insurance is a type of insurance you take out against your own life to provide your loved ones with a sum of money when you pass away. People take out life insurance policies for all sorts of reasons, including to cover the cost of paying off a mortgage or larger debt. This page covers what life insurance can cover generally. Research by LV= found that millions of mortgage holders and private renters are worried about money and feeling stressed and anxious. However, a large proportion of renters, freelance workers and self-employed people don’t have an income protection product to provide an income if illness or injury leaves them unable to work.

We're here to help and answer your questions, from General Life Insurance with Critical Illness questions through to Life Insurance with Critical Illness claims.LV= General Insurance is part of the Allianz Group. Allianz is proud to be the Worldwide Insurance Partner of the Olympic and Paralympic Movements from 2021-2028. Supporting you. From help reducing your energy usage at home to essential checks when buying a used car - our support hub has you covered.

Decreasing life insurance cover is generally cheaper than level life insurance. Fixed monthly premiums. Interested in level or decreasing life insurance? At LV=, we provide both decreasing and level life insurance. In 2023 alone, we paid out £87 million to support over 5,500 families who sadly lost their loved ones*.Some people may choose to cancel their life insurance policy once they have paid off their mortgage, as they no longer worry about payments on their house being covered if they pass away. . Protect your loved ones with life insurance from LV=. Premiums start from as little as £5 per month. Life Insurance guides. Life insurance and diabetes .

QUICK ANSWER. Recovering a Google account depends on how you lost it in the first place. If you forgot your password, that's easy to fix. If you were hacked, things just got a lot more.Google Analytics lets you measure your advertising ROI as well as track your Flash, video, and social networking sites and applications.

lv mortgage insurance|lifetime mortgage advice